Navigating the Road: A Young Driver’s Guide to Car Insurance

Getting your driver’s license is a huge milestone, marking a newfound sense of freedom and independence. But with that freedom comes responsibility, and one of the most important responsibilities is securing car insurance. For young drivers, navigating the world of insurance can seem daunting, but understanding the basics is crucial for protecting yourself, your vehicle, and your finances.

Car insurance is a legal requirement in most places. It’s designed to protect you from financial loss in the event of an accident, whether you’re at fault or not. It can cover costs like:

Property Damage: Repairs to your car or another person’s vehicle if you’re involved in a collision.

Driving without insurance can lead to serious consequences, including fines, license suspension, and even jail time. Beyond the legal ramifications, being uninsured leaves you vulnerable to significant financial hardship if an accident occurs.

Young drivers are statistically more likely to be involved in accidents than older, more experienced drivers. This is due to a variety of factors, including:

Lack of Experience: New drivers are still developing their skills and judgment behind the wheel.

Because of this higher risk, insurance companies often charge young drivers higher premiums.

While insurance can be expensive for young drivers, there are ways to find affordable coverage:

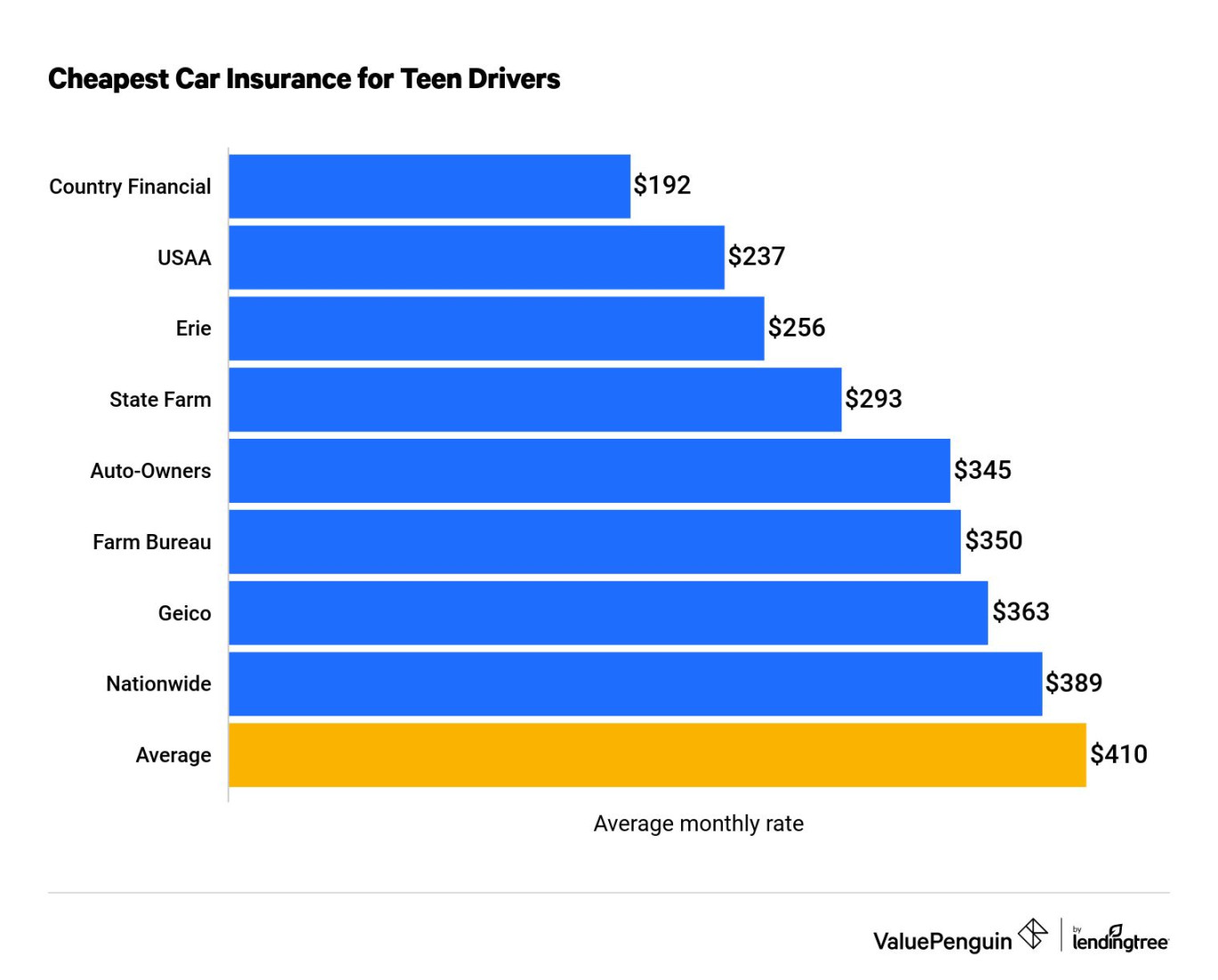

Shop Around: Get quotes from multiple insurance companies to compare rates and coverage options. Don’t just settle for the first quote you receive.

Once you’ve chosen a car insurance policy, it’s essential to understand the details of your coverage. Read your policy documents carefully and ask your insurance agent any questions you may have. Understanding your coverage will help you avoid surprises down the road.

Securing car insurance is a crucial step for any young driver. While it can be expensive, it’s a necessary investment to protect yourself from financial risk. By shopping around, taking advantage of discounts, and understanding your coverage options, you can find affordable insurance that meets your needs. Remember, driving safely and responsibly is the best way to keep your insurance costs down in the long run.