Navigating the Maze: Understanding Your Medical Insurance Options

The landscape of medical insurance can feel overwhelming, a dense forest of acronyms and fine print. Whether you’re a recent graduate, a freelancer, or simply looking to reassess your current coverage, understanding your options is crucial for safeguarding your health and financial well-being.

For many, employer-sponsored health insurance is the most common and often most affordable option. These plans typically offer a range of coverage, from basic to comprehensive, with the employer often sharing the cost of premiums.

Pros: Lower premiums due to employer contributions, often comprehensive coverage, and convenient enrollment.

If you’re self-employed, unemployed, or your employer doesn’t offer insurance, individual and family plans provide a vital safety net. These plans are available through health insurance marketplaces or directly from insurance companies.

Health Insurance Marketplaces (e.g., Healthcare.gov): These online platforms allow you to compare plans from various insurers, determine your eligibility for subsidies, and enroll in coverage. Plans are categorized into metal tiers (Bronze, Silver, Gold, Platinum), each offering varying levels of coverage and cost-sharing.

Pros: Greater plan choice, tailored coverage to your needs, and potential for subsidies through marketplaces.

Several government-sponsored programs offer health insurance to specific populations:

Medicare: For individuals aged 65 and older, as well as those with certain disabilities. Medicare has several parts, including Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage).

Pros: Affordable or free coverage for eligible individuals, comprehensive benefits.

Supplemental insurance policies can help cover costs not covered by your primary health insurance. Examples include:

Dental and Vision Insurance: Covers dental and vision care expenses.

Pros: Enhanced coverage for specific needs, financial protection against unexpected events.

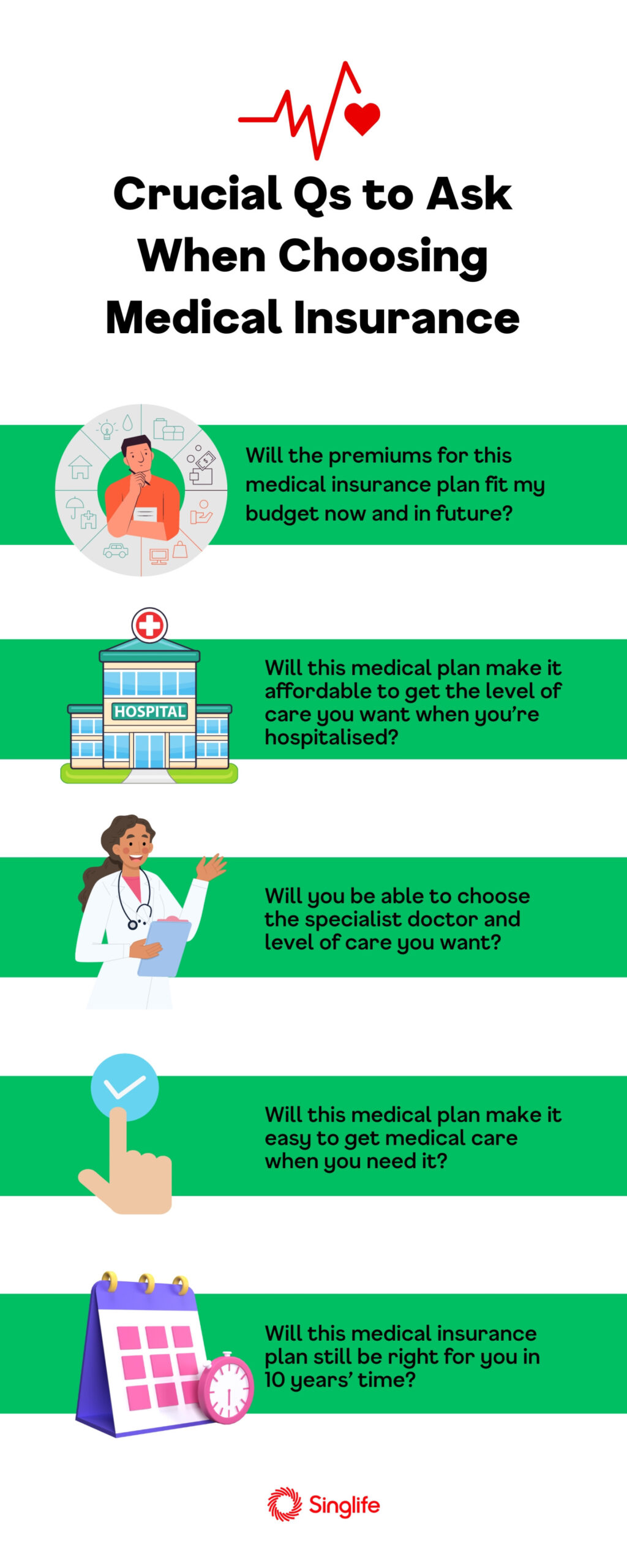

Your Health Needs: Consider your current health status, any pre-existing conditions, and your family’s medical history.

Understanding your medical insurance options empowers you to make informed decisions that prioritize your health and financial security. Don’t hesitate to seek assistance from insurance brokers, navigators, or your state’s health insurance marketplace for guidance.