“`html

Understanding Insurance Deductibles: A Simple Guide

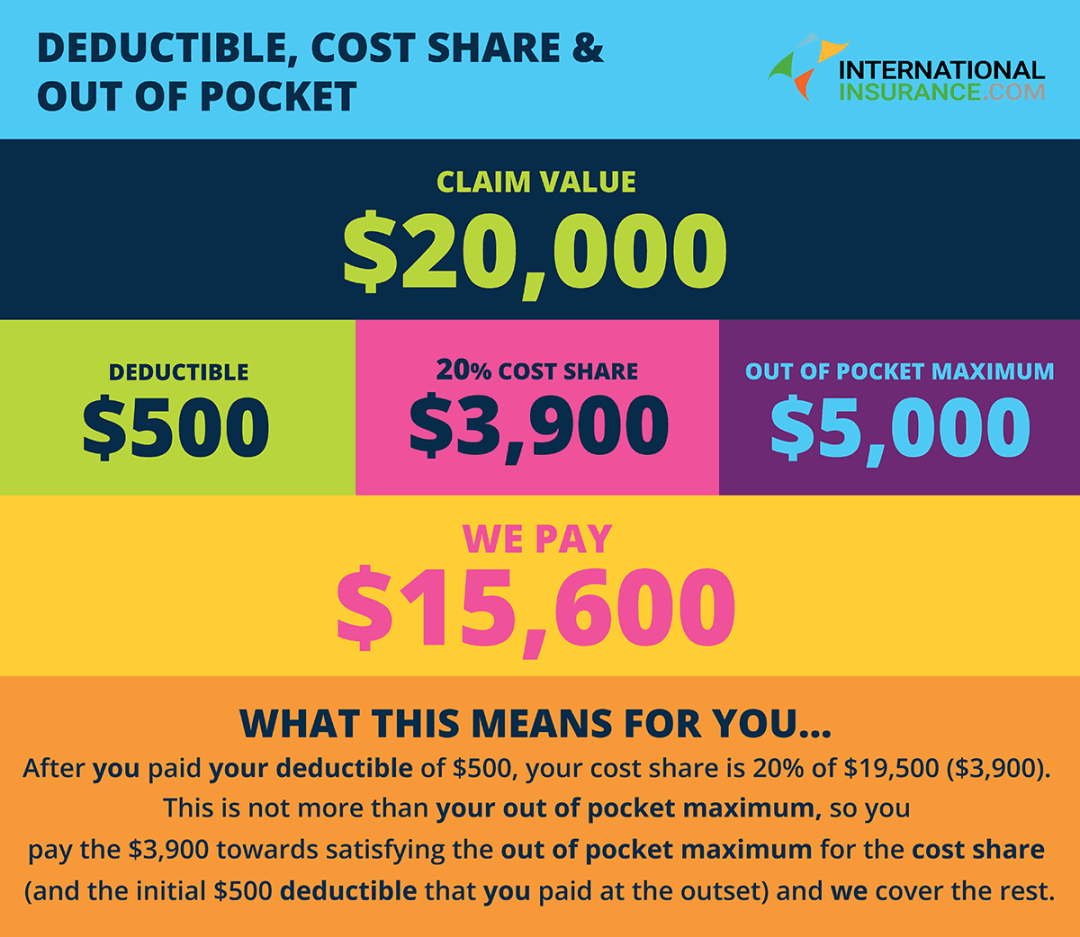

Insurance can be a complex topic, and one of the most common points of confusion is the deductible. Simply put, a deductible is the amount you pay out of pocket before your insurance coverage kicks in. It’s your share of the cost when you file a claim.

Imagine you have a car insurance policy with a $500 deductible. If you’re in an accident and the damage is $2,000, you’ll pay the first $500, and your insurance company will cover the remaining $1,500.

Here’s a breakdown:

You pay the deductible: This is your responsibility.

Deductibles vary depending on the type of insurance:

Health Insurance: You might have a deductible for medical services, prescriptions, or hospital stays.

Selecting the right deductible involves balancing your monthly premiums with your potential out-of-pocket costs.

Higher Deductible:

Understanding your policy: Carefully review your insurance policy to understand your deductible and coverage.

In conclusion, understanding your insurance deductible is essential for making informed decisions about your coverage. By balancing your premiums and potential out-of-pocket costs, you can choose a deductible that fits your needs and budget.

“`