Renters Insurance: A Comprehensive Guide to Protecting Your Belongings

Renting an apartment or house offers flexibility and convenience, but it also means your belongings are vulnerable. While your landlord’s insurance covers the building itself, it doesn’t extend to your personal possessions. That’s where renters insurance comes in. This guide will walk you through everything you need to know about protecting your stuff and your peace of mind.

Renters insurance is a policy designed to protect your personal property and provide liability coverage while you’re renting. It’s an affordable way to safeguard yourself against unexpected events like theft, fire, water damage, and more.

A typical renters insurance policy includes three main types of coverage:

Personal Property Coverage: This covers your belongings, such as furniture, electronics, clothing, and appliances, in case of covered perils. This usually includes:

It’s important to understand what renters insurance doesn’t cover. Common exclusions include:

Flooding: You’ll typically need a separate flood insurance policy.

Determining the right amount of coverage depends on several factors:

Inventory your belongings: Create a detailed list of your possessions and their estimated value. This will help you determine how much personal property coverage you need.

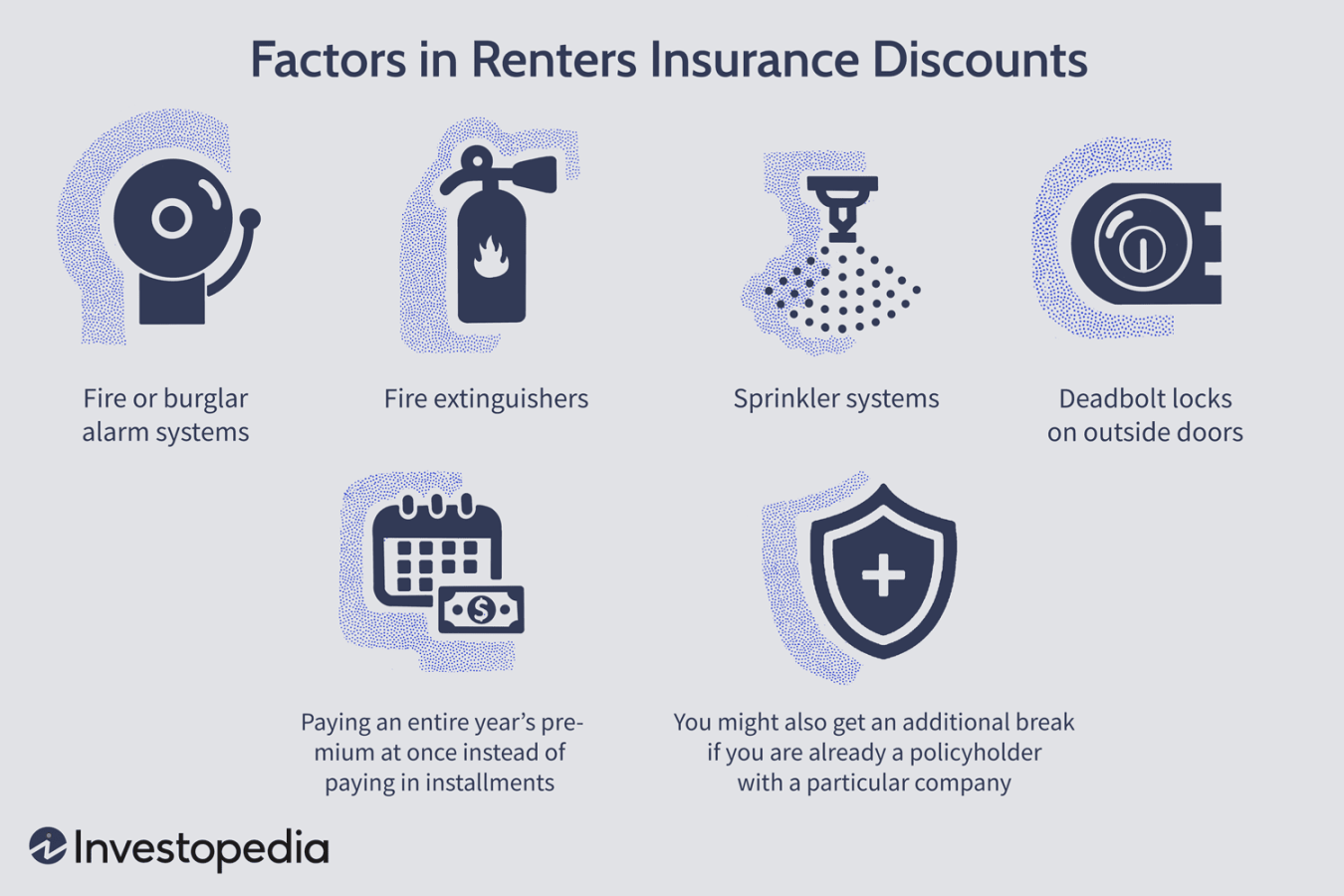

1. Shop around: Get quotes from multiple insurance providers to compare coverage and premiums.

2. Review the policy details: Carefully read the policy documents to understand the coverage limits, exclusions, and deductibles.

3. Ask questions: Don’t hesitate to ask your insurance agent any questions you have.

4. Consider bundling: If you already have auto insurance, you might be able to save money by bundling it with renters insurance from the same provider.

Increase your deductible: A higher deductible can lower your premium.

Renters insurance provides crucial protection against financial losses and unexpected events. It offers peace of mind knowing that your belongings and liability are covered. For a relatively low cost, it can save you significant expenses in the long run.

Protecting yourself and your belongings is a wise investment, and renters insurance is a fundamental part of that protection.